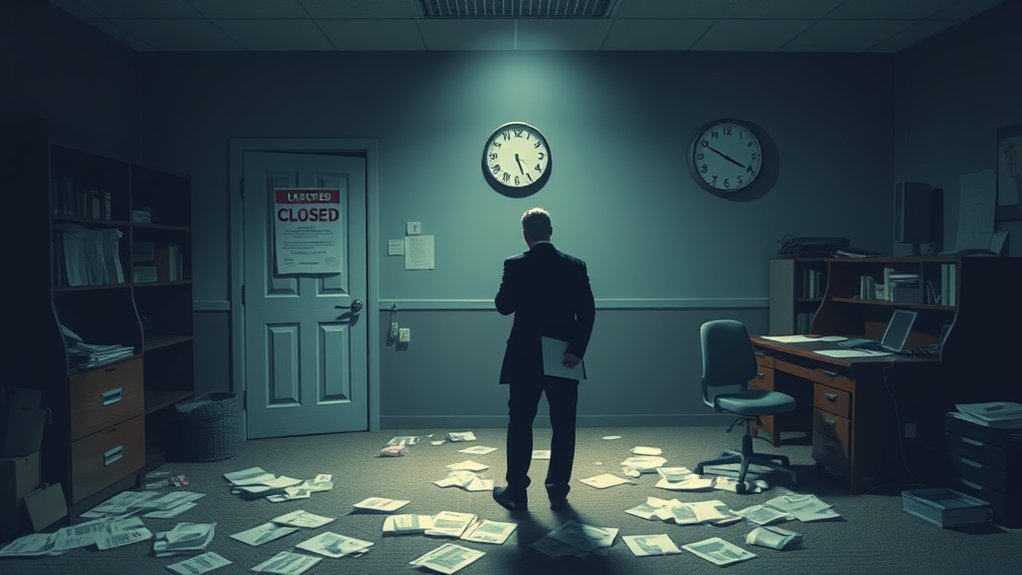

What Happens When a Business Goes Into Administration?

When a business goes into administration, an administrator takes control to assess its financial situation. This process aims to protect creditor interests while exploring options like restructuring or liquidation. You’ll find that the administrator will evaluate assets and liabilities, and may even negotiate with creditors.

The outcome can lead to recovery or closure of the business. Understanding the intricacies of this process will reveal more about the roles involved and ways to navigate challenging financial times.

Highlights

- An administrator is appointed to assess the company’s financial situation and explore options for restructuring or liquidation.

- Company directors lose control, as the administrator prioritizes creditor interests and manages operations during the administration process.

- Administration typically lasts 25 to 30 business days, culminating in a creditors’ meeting to discuss the company’s future.

- Options may include a Deed of Company Arrangement (DOCA) for partial debt repayment or liquidation if recovery is unfeasible.

- Early recognition of financial distress and seeking professional help can improve outcomes and potentially avoid involuntary administration.

What Is Administration?

Administration is a critical legal process for companies facing insolvency. When an insolvent company enters the administration process, a licensed administrator is appointed to evaluate its financial situation and determine viable options. This can involve restructuring, asset sales, or, if necessary, liquidation to repay creditors.

Typically, company directors are sidelined as the administrator takes control of the company’s affairs, prioritizing creditor interests. The administration lasts about 25 to 30 business days, culminating in a creditors’ meeting where the administrator presents a report.

At this juncture, options may include returning control to company directors, entering a Deed of Company Arrangement to facilitate debt repayment, or proceeding with liquidation if restructuring isn’t feasible.

Understanding Insolvency

When a company finds itself in dire financial straits, understanding insolvency becomes essential. Insolvency occurs when a company’s liabilities exceed its assets, meaning it can’t meet its financial obligations. Here are key points to reflect upon:

- Directors of the company may face personal liability for debts if they continue trading while insolvent.

- Signs of impending insolvency include ongoing losses, overdue taxes, and legal threats from creditors.

- The administration process assesses the company’s viability and explores options for restructuring or liquidation.

- During administration, the goal is to benefit creditors while managing company assets effectively.

Reasons for Administration

When a business faces administration, it’s often due to clear financial distress indicators, poor management decisions, or adverse market conditions. You might notice signs like persistent losses or overdue payments that suggest a company’s financial health is deteriorating. Understanding these reasons can help you grasp the intricacies behind the decision to enter administration.

Financial Distress Indicators

How can a business recognize the signs of financial distress that may lead to administration? Identifying these indicators early can be vital for directors to take action before insolvency occurs. Here are four key signs to watch for:

- Ongoing losses: Persistent negative cash flow can signal an unsustainable financial position.

- Overdue taxes: Failing to meet tax obligations can attract legal action from authorities.

- Pressure from creditors: Frequent demands for immediate payments may indicate a potential insolvency.

- Inability to secure financing: Difficulty obtaining additional finance can highlight operational losses and a weakening financial position.

Noticing these signs early might prompt the consideration of voluntary administration as a protective measure against personal financial risks.

Poor Management Decisions

Although poor management decisions often go unnoticed until it’s too late, they can be the catalyst for a business’s downfall into administration. Failing to address ongoing losses and cash flow issues can signal impending insolvency. Strategic errors, such as overestimating future earnings or underestimating costs, often lead to financial distress and increase the risk of voluntary administration.

Inadequate financial reporting complicates matters, preventing timely identification of insolvency and limiting recovery options. Additionally, management’s inability to adapt to creditor pressures can exacerbate financial difficulties.

Decisions to take on excessive debt without a repayment strategy can further jeopardize a company’s stability, necessitating an administrator’s intervention to assess viability and explore potential restructuring options.

Market Conditions Impact

Market conditions can profoundly influence a business’s financial health, often pushing it toward administration. When faced with adverse market conditions, companies may encounter:

- Ongoing losses that lead to declining sales, making it hard to meet financial obligations.

- Rising operational costs without corresponding income can erode profits, increasing insolvency risk.

- Supply chain disruptions hinder effective operations, causing further financial distress.

- Inability to adapt to technological advancements or changing regulations results in a lost competitive edge.

Key Parties Involved

When a business enters administration, several key parties play critical roles in guiding the complex process. You’ll find company directors, facing financial distress, trying to save the business while repaying debts. Creditors, on the other hand, are primarily focused on recovering what they’re owed.

Administrators, appointed by directors, secured creditors, or the Court, assess the company’s assets and liabilities to recommend the best course of action. In voluntary administration, directors retain some control, but in involuntary administration, that control often shifts to the administrators.

These administrators evaluate the company’s viability and prepare reports outlining options like restructuring or liquidating the business. Understanding these roles is essential for grasping the administration process.

Voluntary Administration Process

The voluntary administration process is an essential step for companies facing insolvency, as it allows directors to appoint an administrator who will evaluate the business’s financial health and explore recovery options. Here’s how it generally unfolds:

- Appointment of Administrator: Directors recognize insolvency and engage an administrator to assess the situation.

- Temporary Reprieve: Unsecured creditors cannot make claims for 25 to 30 business days, providing a significant window for resolution.

- Creditors’ Meeting: The administrator reviews financial records and presents findings, recommending either restructuring options or liquidation.

- Decision Time: Creditors vote on the proposed course of action, which may include a Deed of Company Arrangement (DOCA) to potentially save the company and forgive some debts.

Involuntary Administration Process

While companies often seek voluntary administration as a proactive measure, involuntary administration occurs when creditors take matters into their own hands by filing for a winding-up order in court due to outstanding debts. In this process, a court appoints an administrator, who assesses the company’s financial position and takes control of its operations.

A provisional liquidator is then installed, freezing legal actions against the company. The appointed administrator itemizes and values company assets, converting them into cash through asset sales. The proceeds from these sales are used for creditors’ repayment, often resulting in the company’s winding up and cessation of trading.

Outcomes of Administration

Although steering through the outcomes of administration can be complex, understanding the potential paths a business may take is crucial for stakeholders. The administration process can lead to several significant outcomes:

- Restructuring: If the company proves financially viable, it may undergo restructuring to improve profitability.

- Deed of Company Arrangement (DOCA): If approved at the creditors’ meeting, a DOCA allows partial debt repayment while enabling the company to continue trading.

- Liquidation: If recovery options are deemed unfeasible, the business may enter a formal liquidation process.

- Temporary Respite for Unsecured Creditors: During administration, unsecured creditors can’t make claims, providing a breathing space for the business to explore recovery options.

How to Avoid Involuntary Administration

To avoid involuntary administration, you need to prioritize timely bill payments and actively manage your cash flow. Exploring voluntary options can also help you navigate financial difficulties before they escalate.

Timely Bill Payments

Establishing timely bill payments is essential for any business aiming to maintain a healthy cash flow and steer clear of the risks associated with insolvency and involuntary administration. Here are four strategies to help you manage this effectively:

- Implement a strict accounts payable process to guarantee bills are paid on time, avoiding overdue payments that could trigger creditor actions.

- Maintain open communication with suppliers to negotiate favorable payment terms and reduce pressure for immediate payments.

- Regularly review financial statements and cash flow forecasts to anticipate potential issues before they escalate.

- Prioritize payments by focusing on critical debts, allowing you to manage cash flow effectively and mitigate the risk of falling into involuntary administration.

Explore Voluntary Options

When faced with financial challenges, exploring voluntary options can be a strategic way to avoid the pitfalls of involuntary administration. Voluntary administration allows you to protect directors from legal actions while negotiating terms with creditors.

It’s essential to engage insolvency specialists for professional advice, guiding you through the intricacies of the administration process.

| Benefits of Voluntary Administration | Key Considerations |

|---|---|

| Protects directors | Potential loss of control |

| Allows company recovery | May impact company reputation |

| Facilitates restructuring | Costs involved |

Seeking Professional Help

Guiding through the intricacies of administration can be overwhelming, which is why seeking professional help from a lawyer specializing in insolvency is vital. Engaging with legal experts guarantees you’re well-informed about your legal obligations and potential liabilities. Here are four key benefits of professional advice:

- Tailored Strategies: An insolvency practitioner can provide strategies suited to your company’s financial situation.

- Understanding Liabilities: Legal experts help directors grasp the implications of trading while insolvent.

- Creditor Negotiations: Professional assistance can improve negotiations with creditors, potentially leading to favorable outcomes.

- Positive Solutions: Firms like Crest Lawyers are committed to finding positive solutions for your future during challenging times.